The Beginning of Rate Cuts

The Beginning of Rate Cuts?

“A ship In harbor is safe but that’s not what ships are built for.” – John A Shedd

On Friday, August 23rd Jerome Powell gave a speech from Jackson Hole, Wyoming where he said, “the time has come” for lower interest rates. He stressed that the central bank was prepared to slash rates aggressively if the economy were to weaken. The comments were rather blunt, considering his speeches are usually boring, convoluted, and you have to read between the lines to figure out what he really means. The next Federal Reserve meeting is later this September, and that would be when rate cuts could begin. During his speech, Powell kept his options wide open and offered no information as to when or how big the rate cut(s) could be. Many viewed his dovish comments as an admission that the goal of reducing inflation is over, and cutting interest rates to support the economy is the new policy. After his speech at Jackson hole, the S&P 500 moved 1% higher.[i] The last time the Fed made a policy move was when it raised rates to current levels in July 2023. The Fed started the interest rate hike in March of 2022, so we are now 2 ½ years into the tightening cycle.

To many observers, the fact rate cuts were spoken with certainty was a surprise. While inflation has come down, it is still above the Feds target of 2%. On August 14, the July CPI report was release showing a 2.9% year over year increase in inflation. It was the first time since March of 2021 that it was below 3%. The prices of food and energy were up modestly, but transportation services were up 8.8% and shelter was up 5.1%.[ii] With automobiles and housing still so unaffordable, one could argue it is too early for the Fed to be taking a victory laps as it pertains to inflation. So, if inflation is still running higher than the Fed would like, why would they be talking about interest rate cuts? Does it mean the economy isn’t as strong as the Fed would like it to be?

Unemployment

The next Fed meeting is in September. The open question now, and what will drive markets, is how big of a rate cut will we have. Specifically, Mr. Markets wants to know if we will have a relatively small .25% cut or a larger .50% cut. A larger cut would indicate that the market is weakening and a recession likely. The dual mandate of the Federal Reserve is to keep inflation at 2% and to maximize employment. The only reason the Fed would cut rates when inflation is still above 2% Is if they feel employment is weakening. On Wednesday, August 21st, the Bureau of Labor statistics revised down its estimate of total employment in March 2024 by 818,000 jobs, the largest downgrade in 15 years.[iii] That means there were 818,000 fewer job gains than first believed between April 2023 and March 2024. During that time, 174,000 jobs were added per month, which is still substantial, but cracks are starting to show in the labor market. On top of that, the unemployment rate has climbed to 4.3% after starting the year at just 3.7%.[iv] These numbers on the surface seem pretty good. I would guess the Fed most likely has better data that is telling them things are worse than what these numbers are showing. The Fed has been working to navigate a “soft landing” for some time now. The plane is now nearing the ground with the upcoming September Fed meeting, it remains to be seen how soft the landing will be. It also coincides with one of the most contentious and bizarre presidential elections in modern history.

Market Concentration

One of the hallmarks of a healthy stock market is broad participation. A market where small cap names in the Russell 2000 participate equally with the largest of stocks in the S&P 500. A cautionary tale is brewing in the market right now; large cap stocks have become even larger and now make up a larger percentage of the overall stock market. The top 10 stocks in the S&P 500 now account for 38% of the S%P 500 market cap, near the all-time high of 40% seen in June. Over the last decade this amount has more than doubled and now exceeds the dot-com bubble levels by 12%.[v] This means a few big stocks now are the stock market. The media has dubbed them, the “magnificent 7.”

As a financial advisor and portfolio manager, I see this as a threat to many investors who passively invest in the broad stock market via index funds. Many of my clients have retirement plans through their employers who are invested in generic funds that generally track the S&P 500. The beauty of owning a fund that tracks an index like the S&P 500 is the reduction in volatility by owning a basket of 500 stocks. If company XYZ has a terrible earnings report and drops 20%, you most likely don’t notice it. That strategy doesn’t work as well though when only 10 stocks are nearly 40% of the index and one of them has poor results. The majority of these big names are all in the technology sector. If they were to sell off in unison, you would notice it! I’m not calling for a correction or a recession anytime soon, but it does bear mentioning that you may have more risk than you think, and it would be a good idea to take a closer look at what you own. Our belief is an equal weight index may be more appealing than cap weighted index.

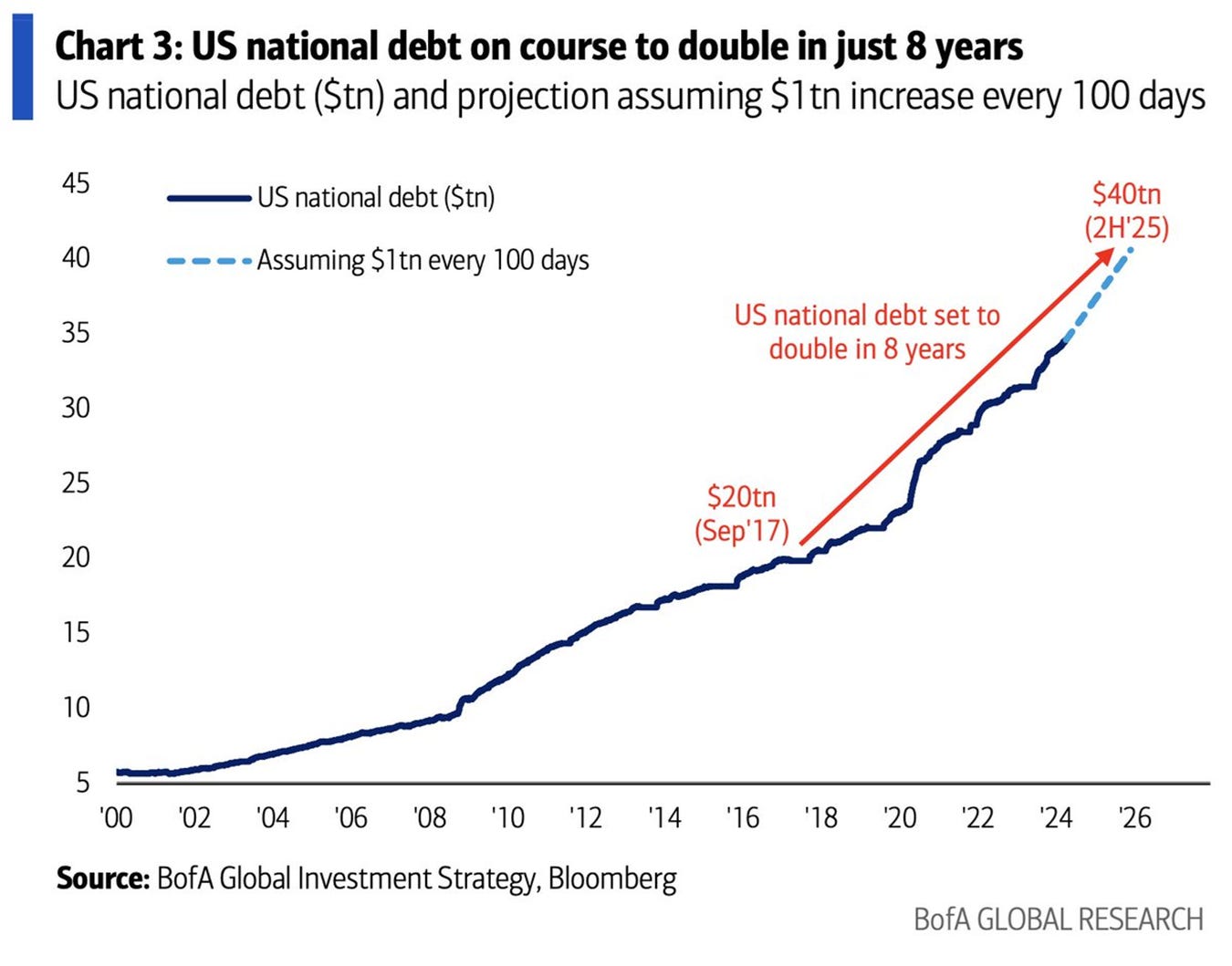

National Debt

Other than promoting economic growth and working to prevent a recession, another major reason to lower interest rates would be to lower the amount of interest paid on the national debt. The national debt just crossed $35 trillion and the congressional budget office expects that number to increase to over $50 trillion by 2034 if things don’t change.[vi]

Higher interest rates mean higher interest payments on the debt which means the debt grows faster and the interest payments grow larger. If there’s any hope of stopping this doom loop, lower rates would be needed. Of course, overspending is the root cause and neither political party has a history of engaging in much of fiscal responsibility. If and when the Fed does ultimately decided to cut rates, the first thing many investors will be watching is how the bond market reacts. There is growing concern that the bond market will be unhappy and government treasury rates could actually increase if the Fed lowers the federal funds rate. This is because borrowers of United States debt would see it as increasingly worthless and would require a higher rate of return. For now, that is speculation and confirmation will be needed but it is something to keep an eye on.

Market Outlook

One the better investments in 2024 has been Gold. Gold has been quietly moving higher and is currently sitting near all-time highs. Despite the price action, there hasn’t been much chatter or excitement. In contrast to the Gold rally in 2011, after the financial crisis, many investors were very excited about the yellow metals and there was somewhat of a mania back then. This time around, it feels like crickets…

Despite the upward price action, I still see more upside ahead. There are many fundamental catalysts that support a bullish case for the centuries old store of value:

- The threat of escalating war in the middle east and with Russia and Ukraine. Simply put, the involvement of Iran with Israel or the United States with Russia would send investors to safe havens like Gold.

- If the Fed lowers rates during high inflation, that should lower the value of the dollar and cheaper dollars mean rising prices for dollar denominated assets like gold.

- Politics. Both parties are promising to “fight inflation.” We've seen this story before... The proposed policies, in one way or another, will only exacerbate U.S. debt and inflation, and certainly won't get to the root of the problem: fiat currency and money printing.

The next two months will most likely be more volatile than usual. Between the Fed meeting, the presidential election, and the ongoing wars abroad, there are more reasons than usual for an increase in volatility. Here at Carlson Asset Management, we will continue to look to find the right investments for the current market environment and for our client’s portfolios. In the meantime, I advise you to do your best to keep emotions in check. If you would like to schedule a review meeting or just to chat, feel free to give our office a call!

Sincerely,

Bruce Carlson, CFP®

President

Carlson Asset Management

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security.