“Liberation Day” Market Rout

“Liberation Day” Market Rout

“If goods can’t cross borders, armies will.”

- Cordell Hull, U.S. Secretary of State from 1933 to 1944

The past week has been a rollercoaster for financial markets, driven by President Trump’s “Liberation Day” tariff announcement on April 2, 2025. This unprecedented move introduced a 10% baseline tariff on all U.S. imports, with significantly higher tariff rates targeting a broad spectrum of countries. Global markets have reacted sharply, with the S&P 500 dropping nearly 6% by week’s end and the Nasdaq sliding into bear market territory, down over 20% from its recent peak.[i] Volatility spiked as investors grappled with the uncertainty of Trump’s plan, which aims to boost U.S. manufacturing but risks igniting a global trade war. In this update, I’ll break down what’s happened, why the market is uneasy, and what it could mean for your portfolios.

Trump’s tariff strategy is bold and centers on China as the primary target. The 34% levy on Chinese imports (effectively 54% with existing tariffs) is designed to pressure Beijing into reducing it’s trade surplus with the U.S. and to encourage companies to relocate production stateside. (the ongoing back and forth changes hourly and may be different by the time you read this).[ii] For example, Trump has pointed to tech giants like Apple, which rely heavily on Chinese manufacturing, as firms that could benefit from reshoring. However, the market isn’t buying the rosy outlook. Stocks like Apple and Nvidia fell 7-8% last week as investors worried about higher costs, disrupted supply chains, and weaker global demand. The fear is that these tariffs, rather than sparking a manufacturing renaissance, could shrink corporate profits and slow economic growth, a scenario Wall Street hates.

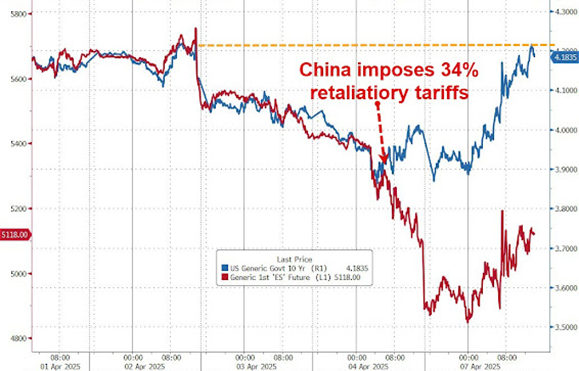

A key piece of Trump’s plan seems to hinge on lowering interest rates to offset tariff-driven inflation and stimulate the economy. By crashing markets and pushing investors into safe-haven U.S. Treasuries, he may be betting that the Federal Reserve will cut rates to stabilize things. But here’s the catch: China retaliated with its own 34% tariff on U.S. goods and reportedly sold $50 billion in Treasuries last week. If China keeps dumping U.S. debt, it could flood the market with supply, driving yields up (and prices down), counteracting Trump’s goal.

On the chart below, the red line shows the S&P 500 and the blue line shows the 10 year treasury yield. The yields briefly dropped when the market started dropping but reversed course back to where they started without the subsequent rally in markets. Someone is selling US Treasuries and a good guess would be China.

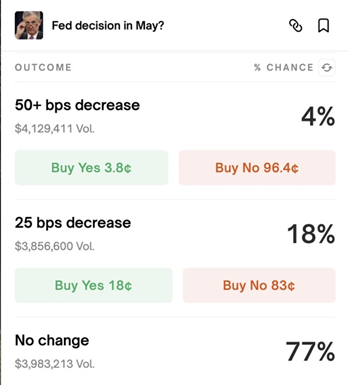

Another component of Trump’s strategy is that by engaging in chaotic foreign policy with unprecedented tariff declarations, the resulting market turmoil will increase the odds of a Federal Reserve rate cut. Goldman Sachs now predicts 130 basis points of easing by year-end 2025 but the betting markets say no change during the upcoming meeting in May.

The negotiations are not only ongoing between the Trump administration and foreign nations, but also with the Federal Reserve chairman Jerome Powell. This will be something to keep an eye one as pressure mounts on all parties involved.

On the upside, if Trump’s tariffs succeed, we could see a revival of U.S. jobs in sectors like steel or autos, and a weaker dollar might boost exports over time. The 25% tariff on foreign vehicles, for instance, could give domestic automakers a leg up. But the downside risks are steep: higher consumer prices, retaliatory tariffs from allies like the EU and Japan (20% and 24%, respectively), and a potential global recession. JPMorgan now pegs that risk at 60%. This isn’t a partisan take; Trump’s approach is uncharted territory, dwarfing even the Smoot-Hawley tariffs of 1930 in scope. It could work, but it could also spectacularly fail, leaving markets and your investments caught in the crossfire.

The past week has underscored the uncertainty of Trump’s tariff gamble. As your advisor, I’m monitoring how this unfolds; especially China’s next moves and the Fed’s response. We’ve seen $5 trillion wiped off global stocks since last Tuesday, and while some see this as a buying opportunity, the risks of prolonged volatility are real. My advice: Stay diversified, lean into more defensive assets like short-term bonds and money markets if you’re feeling risk averse, please give us a call to discuss your accounts. I have been through these periods of enhanced volatility many times in my 43-year career. The one thing I have learned is don’t panic and sell during the big drops, and don’t buy into the large snapbacks. Warren Buffet famously says “Sell when others are greedy and buy when others are fearful” I think that is good advice for these times.

Trump’s experiment is rewriting the economic playbook, and while it’s too early to predict the outcome, we’ll navigate this together with a steady hand.

Sincerely,

Bruce Carlson, CFP®

President

Carlson Asset Management

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security.

[i] https://economictimes.indiatimes.com/markets/stocks/news/trumps-liberation-day-tariffs-wipe-5-trillion-off-wall-street/articleshow/119998014.cms?from=mdr

[ii] https://www.nbcnews.com/business/economy/goods-imported-china-are-now-facing-54-tariffs-rate-rcna199401